Businesses to Get Boost from $8.8B Home Energy Rebates Program — Home Energy Rebates Demystified (Part 1)

Introduction

For firms in the United States, the Inflation Reduction Act (IRA) has released a flood of funding for clean energy demonstration and deployment. Tens of billions of dollars in the form of direct grants and loans have been authorized for distribution by the Department of Energy as well as other agencies. While companies and businesses have rightfully paid close attention to these direct sources of funding, firms should also be aware of over eight billion dollars in rebates to homeowners that could present additional business opportunities.

Under the “Home Energy Rebates” program, the IRA made available $8.8 billion in funds to help reduce US households’ energy bills. Separated into two rebate programs (explained below), Home Energy Rebates will be administered by the states based on individually designed plans within a framework defined and overseen by DOE.[1]

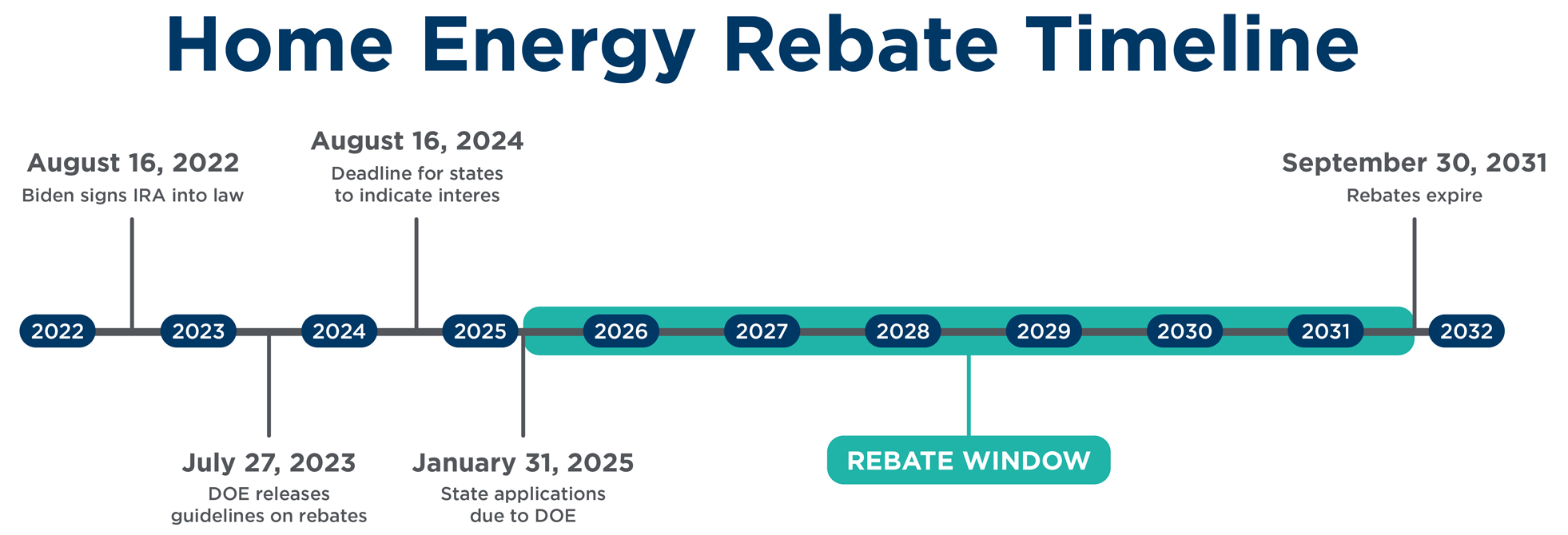

States have until August 16, 2024, to notify the DOE of their participation in the Home Energy Rebates program with full applications submitted to the DOE by January 31, 2025, to allow them to access program funding. Many states are well ahead of that deadline. On April 18, 2024, New York became the first state approved to receive funding to administer the rebate program, potentially leading to rebate funding that will be available to consumers as soon as this summer. Homeowners must complete their home energy projects before September 30, 2031, for those projects to be eligible for the home energy rebates.

|

Along with benefiting homeowners, these rebates present significant business opportunities to well-positioned and well-prepared firms. Home Energy Rebates promises to open new lines of business to firms operating in a variety of industries, including home appliance manufacturers, contractors, utilities, and technology companies.

In this two-part series, we at ML Strategies will provide an overview of Home Energy Rebates and demonstrate the range of opportunities presented to firms by this significant program. This first article provides a high-level overview of the two programs that are part of Home Energy Rebates and explains their interest not just for homeowners but also for businesses. The second article will provide in-depth explanations of the programs, covering details such as rebate amount, eligibility, and application process.

Overview of the HOMES and HEEHRA Rebates

The Home Energy Rebates consist of two separate rebate programs: the “Home Efficiency Rebates” (HOMES) and the “Home Electrification Rebates” (HEEHRA).

HOMES Rebate Program

Section 50121 of the IRA offers rebates for energy efficiency upgrades that improve the overall energy performance of single-family homes or multi-family buildings. This program is referred to as “Home Efficiency Rebates” or “HOMES Rebates.”

Simply put, HOMES rebates are supplied for home retrofit projects that improve the energy efficiency of households. The relevant section of the IRA states that under HOMES, states will “provide rebates to homeowners and aggregators for whole-house energy saving retrofits begun on or after the date of enactment of this Act and completed by not later than September 30, 2031.”

Rebate amounts under the HOMES program are based on the project’s energy savings.[2] Rebate amounts are also dependent upon the income of the household relative to their locale.[3] If a household’s income falls below a certain threshold, then they are eligible for higher rebates under HOMES.

While states have the discretion to set stricter eligibility requirements, the baseline participation requirements for HOMES set by the DOE are quite inclusive. Per DOE’s requirements, any homeowner can apply to receive a HOMES rebate. Whether that rebate is granted, and the size of the HOMES rebate, if granted, is contingent on a variety of factors.

HEEHRA Rebate Program

Section 50122 of the IRA authorizes the creation of programs to provide rebates for the purchase and installation of certain qualified appliances and building materials that improve energy efficiency. This program is referred to as the “Home Electrification Rebates,” the “HEEHRA Rebates,” or the “HEEHR Rebates.”

Purchases eligible for this rebate are called Qualified Electrification Projects (QEPs). To be classified as a QEP, a project must include the purchase and installation of a qualified appliance or building material carried out as part of new construction or to replace a non-electric appliance.[4]

Unlike HOMES, eligibility for HEEHRA is limited to low- and middle-income households.[5] That being said, baseline HEEHRA eligibility requirements are broad enough to capture a large percentage of American households.

Combining Rebates

States are encouraged to design their Home Energy Rebates programs to allow for effective combinations of funding sources. As such, the DOE has established only two limitations to the “stackability” of the Home Energy Rebates.

- The total combination of all immediate upfront funding sources cannot exceed the total project cost.

- Neither the HOMES Rebates nor the HEEHRA Rebates may be combined with other federal grants or rebates for the same single upgrade, including each other.

Status of States’ Administration of the Home Energy Rebates

During an April 16, 2024, congressional hearing, DOE Secretary Jennifer Granholm urged states to file their applications so funding could be flowing to consumers this summer. “We are hoping that we can convince states to accelerate their strategies so that we have the summer of rebates,” stated Granholm. On April 18, 2024, New York Governor Kathy Hochul announced that DOE had approved $158.4 million in funding for New York to administer HEEHRA rebates. The New York State Energy Research and Development Authority “is planning to launch expanded IRA Home Energy Rebate program offers later this year after the full scope application has been submitted and approved by DOE.” States, including California and North Carolina, have also announced that they anticipate Home Energy Rebates to be available to their residents later this year.

The Home Energy Rebates Present a Great Opportunity— To Businesses That Are Prepared

Though Home Energy Rebates is directed towards consumers, firms in a variety of industries stand to gain much from this $8.8 billion program.

- Manufacturers of eligible appliances and building materials could see increased sales as homeowners purchase appliances and retrofit materials with Home Energy Rebates funds.

- Contractors could see increased business if approved by their state to work on Home Energy Rebates projects.[6]

- Governmental, philanthropic, commercial, and nonprofit organizations that help low- and moderate-income households access the HEEHRA rebates may receive installation incentives of up to $250 per household.

- Firms can serve as “aggregators,” financing portfolios of HOMES rebates (to be explained in more detail in the second part of this series).

How ML Strategies Can Help

Though Home Energy Rebates has the potential to do great good, the chief weakness of the program is its complexity. Each state has great latitude in program administration, and as such, state energy offices will have to go to great efforts to effectively disseminate information about the rebates to eligible homeowners. This complexity is also a potential issue for firms seeking to open new lines of business through Home Energy Rebates.

We at ML Strategies have helped companies make sense of federal funding programs for years and are uniquely positioned to help you understand how the Home Energy Rebates program impacts your business. Our professionals have decades of experience working in and interfacing with state governments, Congress, and executive agencies.

In the coming weeks, we will release the next article in our series, which will provide an in-depth presentation of the HOMES and HEEHRA programs. Please feel free to contact us if you have further questions.

Endnotes

[1] This type of program structure is not new. One may take, for instance, the DOE administers the Weatherization Assistance Program, which is implemented by the states.

[2] There are two ways that energy savings can be calculated for HOMES (the modeled and measured pathways). We will discuss this aspect further in the following article in this series.

[3] For the sake of the Home Energy Rebates program, income is calculated in reference to the homeowner’s Area Median Income (AMI). Based on available information, the “Area” under consideration when calculating homeowners’ income level with regard to HOMES will be their county. In other words, absolute income is not the factor at issue when deciding the rebate amount for this program; rather, it is the homeowner’s income relative to their county’s median family income. We will explore this issue in-depth in this series’ subsequent newsletter.

[4] We will present a list of HEEHRA-qualified appliances and building materials in the second article in our series. See here for the full list.

[5] Defined as residents with a household income that is 150% of AMI or less.

[6] The DOE mandates that each state administering Home Energy Rebates maintain a “qualified contractor list.” Only contractors on this qualified contractor list will be allowed to perform Home Energy Rebates projects.

Content Publishers

John Lushetsky

Senior Vice President